Europe Image Sensor Market by Technology (Complementary Metal Oxide Semiconductor, Charged Coupled Device, Contact Image Sensor), by Application, by Geography - Analysis and Forecast to 2019

The report “Europe image sensor market forecast, 2014-2019” analyzes the image sensor market in Europe and the factors driving the market in the region. The European image sensor market accounts the revenue of $1,849.7 million in 2014 and is expected to reach the value of $1,888.7 million by 2019 at a CAGR of 0.4% for the forecast period.

The U.K. and France are the major markets for image sensors due to their automotive and process oriented industries. In Europe, vehicles are used for busy city streets, where lane-departure systems are less effective. Blind-spot cameras use image sensors and they are capable of providing a warning signal to the driver. Blind-spot detection has been offered on some Volvo models since 2005 in Europe. The European New Car Assessment Programme (Euro NCAP) launched a reward programme, Euro NCAP Advanced, to encourage adoption of highly developed safety techniques which will help pull the demand for image sensors from automotive and transportation segment. Image sensors are becoming more popular in a wide range of industrial automation applications. Machine vision systems, robots, wafer inspections, quality checks and printed circuit boards are key application areas which make use of image sensors. Hence, increased industrial automation will be able to drive image sensor market in Europe.

CMOS, CCD, and contact image sensor (CIS) are the technologies used in image sensors. The low cost of CMOS technology and lower power consumption has helped CMOS imagers in gradually overtaking the CCDs in the image sensor market. CMOS bags the highest revenue in Europe image sensor market by technology in 2014.

The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in the image sensor market and extensively covered in this report are Aptina Imaging Corporation, Omnivision Technologies, Ltd., Samsung Electronics, and Sony Corporation.

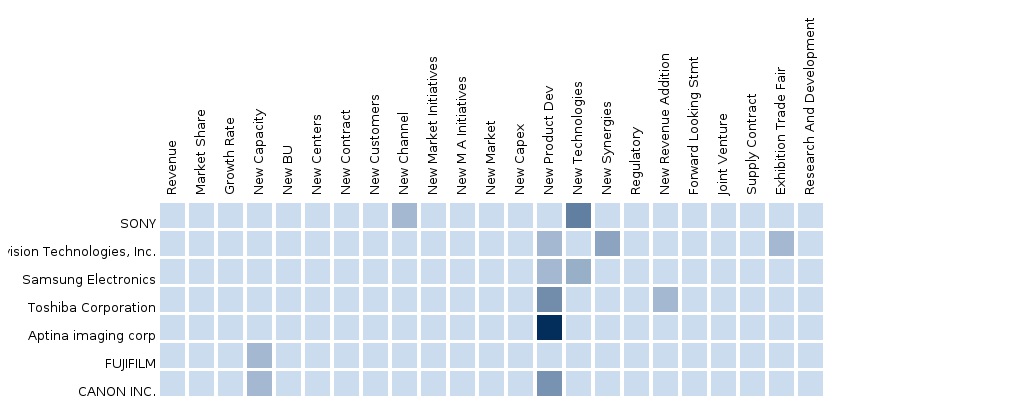

Segment and country specific company shares, news & deals, M&A, segment specific pipeline products, product approvals, and product recalls of the major companies have been detailed.

Customization Options:

With market data, you can also customize MMM assessments that meet your company’s specific needs. Customize to get comprehensive industry standard and deep dive analysis of the following parameters:

Technological Data

- Region wise end-user adoption rate analysis of the technology (CMOS, CCD, and CIS)

- Technology matrix which gives a detailed comparison of technologies (CMOS, CCD, and CIS) mapped at country and sub-segment level

- Upcoming development in the technology (company and country-wise)

- Technology matrix which gives detailed comparison of technology mapped with different manufacturing types (FSI,BSI) and operating spectrums (visible, IR, X-ray)

Price Trend Analysis

- Average selling price (ASP) analysis of image sensors with respect to different applications at country-level

- Analysis of material cost, processing cost, and assembly cost incurred in making an image sensor

Data From Key Players

- Key revenue pockets for the manufacturing and supplying firms

- Various firms’ opinions about different and upcoming market trends

- Qualitative inputs on macro-economic indicators, mergers and acquisitions

Country-level Data Analysis

- Country-level data for top countries in the image sensor market

- Country specific data showing opportunities in different regions

Trend Analysis of Applications

- Application matrix which gives a detailed comparison of application portfolio of each company in Europe

- Application matrix which gives a detailed comparison of application portfolio using different technology

Table of Contents

1 Introduction

1.1. Objectives of the Study

1.2. Market Segmentation & Coverage

1.3. Stakeholders

2 Research Methodology

2.1. Integrated Ecosystem of Europe Image Sensor Market

2.2. Arriving at the Europe Image Sensor Market Size

2.1.1 Bottom-Up Approach

2.1.2 Demand Side Approach

2.1.3 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary

4 Market Overview

4.1 Introduction

4.2 Europe Image Sensor Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand-Side Analysis

5 Europe Image Sensor Market, By Technology

5.1. Introduction

5.2. Complementary Metal–Oxide–Semiconductor (Cmos)

5.3. Charge Coupled Device (Ccd)

5.4. Contact Image Sensor (Cis)

5.5. Europe Image Sensor Market: Technology Comparison With Parent Market

5.6. Europe Cmos Image Sensor Market, By Country

5.7. Europe Ccd Image Sensor Market, By Country

5.8. Europe Cis Image Sensor Market, By Country

6 Image Sensor Market, By Application

6.1 Introduction

6.2 Europe Image Sensor Market, By Application

6.3 Image Sensor Market in Medical , By Medical Application

6.4 Europe Image Sensor Market in Automotive Sector, By Automotive Application

6.5 Europe Image Sensor Market in Defence and Aerospace Application Sector, By Application

6.6 Europe Image Sensor Market in Consumer Sector, By Application

6.7 Europe Image Sensor Market in Industry, By Application Type

6.8 Europe Image Sensor Market in Surveillance, By Application

7 European Image Sensor Market, By Country

7.1 Introduction

7.2 U.K. Image Sensor Market

7.3 Germany Image Sensor Market

7.4 France Image Sensor Market

7.5 Italy Image Sensor Market

8 Image Sensor Market Competitive Landscape

8.1 Introduction

8.2 Europe Image Sensor Market: Company Share Analysis

8.3 New Product Development and New Launches

8.4 Agreements, Partnership, Joint Ventures, and Collaborations

9 Company Profiles

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Omnivision Technologies Ltd.

9.2 Aptina Imaging Corporation

9.3 Samsung Electronics

9.4 Sony Corporation

9.5 Toshiba Corporation

*Details On Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

10 Appendix

10.1 Customization Options

10.2 Product Portfolio Analysis

10.3 Country-Level Data Analysis

10.4 Product Comparison of Various Competitors

10.5 Trade Analysis

10.6 Related Reports

11 Introducing RT: Real-Time Market Intelligence

11.1 RT Snapshots

11.1.1 Snapshot 1: Ecosystem

11.1.2 Snapshot 2: Quantitative Chart

11.1.3 Snapshot 3: Heat Map, Companies

List of Tables (42 Tables)

Table 1 Europe Application Market, 2014 (Usd Mn)

Table 2 Europe R&D Expenditure, , 2012–2013 (Usd Mn)

Table 3 Europe Image Sensor Market: Comparison With Parent Market, 2013–2019 (Usd Mn)

Table 4 Europe Image Sensor Market: Drivers and Inhibitors

Table 5 Europe Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Table 6 Europe Image Sensor Market, By Technology2014, Usd Mn

Table 7 Europe Image Sensor Market, By Country, 2013-2019 (Usd Mn)

Table 8 Europe Image Sensor Market: Comparison With Application Markets, 2013 - 2019 (Usd Mn)

Table 9 Europe Image Sensor Market, By Technology, 2013-2019 (Usd Mn)

Table 10 Europe Image Sensor Market: Technology Comparison With Parent Market, 2013–2019 (Usd Mn)

Table 11 Europe Cmos Image Sensor Market, By Country, 2013–2019 (Usd Mn)

Table 12 Europe Ccd Image Sensor Market, By Country, 2013-2019 (Usd Mn)

Table 13 Europe Cis Image Sensor Market, By Country, 2013 - 2019 (Usd Mn)

Table 14 Europe Image Sensor Market, By Application, 2013 - 2019 (Usd Mn)

Table 15 Europe Image Sensor Market in Medical, By Medical Application, 2013 - 2019 (Usd Mn)

Table 16 Europe Image Sensor Market in Automotive Sector, By Automotive Application, 2013-2019 (Usd Mn)

Table 17 Europe Image Sensor Market in Defence and Aerospace Application Sector, By Application, 2013 - 2019 (Usd Mn)

Table 18 Europe Image Sensor Market in Consumer Sector, By Application, 2013-2019 (Usd Mn)

Table 19 Europe Image Sensor Market in Industry, By Application Type, 2013-2019 (Usd Mn)

Table 20 Europe Image Sensor Market in Surveillance, By Application, 2013 - 2019 (Usd Mn)

Table 21 Europe Image Sensor Market, By Country, 2013-2019 (Usd Mn)

Table 22 U.K. Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Table 23 Germany Image Sensor Market, By Application, 2013 - 2019 (Usd Mn)

Table 24 France Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Table 25 Italy Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Table 26 Image Sensor Market: Company Share Analysis, 2013 (%)

Table 27 Middle-East and Africa: New Product Development and New Launches

Table 28 Image Sensor Market: Agreements, Partnerships, Joint Venturess, and Collaborations

Table 29 Omnivision Technologies, Ltd: Operating Data,2009 – 2013 (Usd Mn)

Table 30 Omnivision Technologies, Ltd.: Related Developments

Table 31 Aptina Imaging Corporation: Related Developments

Table 32 Samsung Electronics: Annual Revenue, By Business Segments, 2008–2012 (Usd Mn)

Table 33 Samsung Electronics: Annual Revenue, By Geographic Region Segments, 2008–2012 (Usd Mn)

Table 34 Samsung Electronics: Operating Data, 2010-2013 (Usd Mn)

Table 35 Samsung Electronics: Related Developments

Table 36 Sony Corporation: Annual Revenue, By Business Segments, 2009–2013 (Usd Mn)

Table 37 Sony Corporations: Annual Revenue, By Geographic Region Segments, 2009–2013 (Usd Mn)

Table 38 Sony Corporations: Operating Data (Usd Mn), 2010-2013

Table 39 Sony Corporation: Related Developments

Table 40 Toshiba Corporation: Annual Revenue, By Business Segments, 2009–2013 (Usd Mn)

Table 41 Toshiba Corporation: Operating Data, 2009-2013(Usd Mn)

Table 42 Toshiba Corporation: Related Developments

List of Figures (26 Figures)

Figure 1 Europe Image Sensor Market: Segmentation & Coverage

Figure 2 Europe Image Sensor Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Bottom-Up Approach

Figure 5 Demand Side Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 Europe Image Sensor Market Snapshot

Figure 8 Image Sensor Market: Growth Aspects

Figure 9 Europe Image Sensor Market: Comparison With Parent Market, 2013-2019 (Usd Mn)

Figure 10 Europe Image Sensor Market, By Application, 2014 & 2019 (Usd Mn)

Figure 11 Europe Image Sensor Market, By Technology 2014, Usd Mn

Figure 12 Europe Image Sensor Market , By Country, 2014 & 2019 (Usd Mn)

Figure 13 Europe Image Sensor Market: Comparison With Application Markets, 2013 - 2019 (Usd Mn)

Figure 14 Europen Image Sensor Market, By Technology, 2014 & 2019 (Usd Mn)

Figure 15 Europe Image Sensor Market: Technology Comparison With Parent Market, 2013–2019 (Usd Mn)

Figure 16 Europe Cmos Image Sensor Market, Bycountry, 2013–2019 (Usd Mn)

Figure 17 Europe Ccd Image Sensor Market, By Country, 2013 - 2019 (Usd Mn)

Figure 18 Europe Cis Image Sensor Market, By Country, 2013 - 2019 (Usd Mn)

Figure 19 Europe Image Sensor Market, By Application, 2014-2019 (Usd Mn)

Figure 20 Demand Side Analysis

Figure 21 Europe Image Sensor Market in Medical, By Medical Application, 2014 & 2019 (Usd Mn)

Figure 22 Europe Image Sensor Market in Automotive Sector, By Automotive Application, 2013-2019 (Usd Mn)

Figure 23 Europe Image Sensor Market in Defence and Aerospace Application Sector, By Application, 2013-2019 (Usd Mn)

Figure 24 Europe Image Sensor Market in Consumer Sector, By Application, 2013-2019 (Usd Mn)

Figure 25 Industry Image Sensor Market in Europe, By Industry Application Type, 2013-2019 (Usd Mn)

Figure 26 Europe Image Sensor Market in Surveillance, By Application, 2014 & 2019 (Usd Mn)

Figure 27 Europe Image Sensor Market in Surveillance, By Application, 2013 - 2019 (Usd Mn)

Figure 28 Europen Image Sensor Market: Growth Analysis, By Country, 2014 & 2019 (Usd Mn)

Figure 29 U.K. Image Sensor Market Overview, 2014 & 2019 (%)

Figure 30 U.S. Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Figure 31 U.K. Image Sensor Market: Application Snapshot

Figure 32 Germany Image Sensor Market Overview, 2014 & 2019 (%)

Figure 33 Germany Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Figure 34 Germany Image Sensor Market: Application Snapshot

Figure 35 France Image Sensor Market Overview, 2014 & 2019 (%)

Figure 36 France Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Figure 37 France Image Sensor Market: Application Snapshot

Figure 38 Italy Image Sensor Market Overview, 2014 & 2019 (%)

Figure 39 Italy Image Sensor Market, By Application, 2013-2019 (Usd Mn)

Figure 40 Italy Image Sensor Market: Application Snapshot

Figure 41 Image Sensor Market: Company Share Analysis, 2013 (%)

The European image sensor market had a market size of $1,849.7 million in 2014 and is expected to reach $1,888.7 million by 2019 at a CAGR of 0.4% during 2014 – 2019. An image sensor is an electronic photosensitive device which is used to convert an optical image into an electronic signal. It consists of millions of photodiodes and acts as an image receiver in digital imaging equipment. It is widely used in digital cameras, camera modules, and other imaging devices.

Europe is well known for its automotive and consumer market. The potential applications of image sensors in vehicles are growing, with estimates that in the future there are likely to be five to twenty cameras in cars, used in a mix of machine and human vision applications. Thus, image sensors have great scope in the European automotive sector. The European image sensor market in the automotive application segment was valued at $95.3 million in 2014, and is projected to grow at a CAGR of 4.7% during the forecast period.

In Europe, vehicles are used for busy city streets where lane-departure systems are less effective. Blind-spot cameras use image sensors and they are capable of providing a warning signal to the driver. Blind-spot detection has been offered in some Volvo models since 2005 in Europe.

The mobile phone camera market is based almost entirely on CMOS sensors and the large consumer market has pushed CMOS technology to the edge, including the development of advanced pixels with low noise. Since the consumer electronics market holds a major share in image sensing, there will be an increase in the demand for mobile phones and other consumer electronics in the coming years in the European market.

Previously, there used to be analog sensors such as video tubes which are currently replaced by mostly charge-couple device (CCD) and complementary metal oxide semiconductor (CMOS) image sensors. The increasing popularity of photography in the youth is also fueling the growth of image sensor market.

This study has been undertaken to understand the market dynamics in the area of image sensors, current revenue generated, and future revenue forecast. The study has been conducted to identify the key applications and geographical regions where huge opportunities can be expected in the coming future. Total image sensor shipments and its average selling prices have been analysed in order to arrive at the final market size of the image sensor. Furthermore, the image sensor revenue has also been analysed by clubbing the revenue of the top market players involved in the development of image sensor. This is further verified after having discussion with key market players.

The image sensor type market is broadly classified into CCD sensors, CMOS sensors, and Contact image sensors (CIS). CMOS image sensors accounted for the largest share of the image sensor market in 2014. The market for CMOS image sensors is expected to grow at CAGR of 1.5% from 2014 to 2019. This is mainly because of an increased use of CMOS sensors in consumer, automotive, surveillance, and industrial segments as it is able to offer features such as low power consumption, low manufacturing cost, ease of integration, and higher frame rate. Additionally, with the use of BSI technology, CMOS image sensors are able to produce better quality of images even in low-light conditions and the implementation of global shutter has made it possible to capture images of fast moving objects without any distortion. This results in an increased market share of CMOS image sensors.

The image sensor application market is broadly segmented into consumer, medical, industrial, surveillance, automotive, and defense and aerospace. The consumer segment held the largest share in the Europe image sensor market, while medical, industrial, and automotive applications are the fastest growing segments in the Europe image sensor market.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement